How to recognize investment scams?

Cheating and treachery are the tricks of fools who do not have enough intelligence to live honestly.

(B. Franklin)

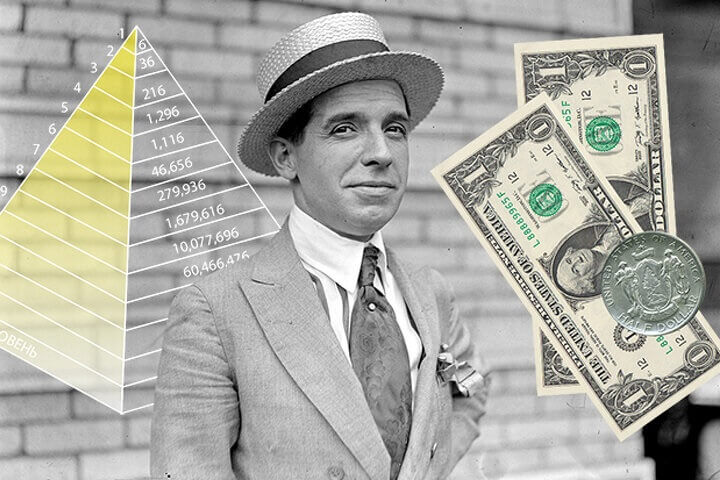

A financial pyramid (also an investment pyramid, a Ponzi scheme or game)

The financial illiteracy of many citizens helps fraudsters to take money from them. I want to tell you about one of the schemes of a fraudulent financial pyramid — this is an investment in a business project. In Russia they say — «If you are warned, then you are armed against disaster.» Be vigilant and save your money. Trust your money to companies that have been proven over the years.

A FINANCIAL PYRAMID (also an investment pyramid, a Ponzi scheme or game) is a system of providing income to members of the structure by constantly attracting funds from new participants: income to the first participants in the pyramid is paid at the expense of subsequent participants. In most cases, the true source of income is hidden, instead a fictitious or insignificant source is declared. It is the substitution or hiding of information that is fraudulent.

Financial pyramids are illegal and directly prohibited in many countries: Australia, Austria, Albania, Brazil, Great Britain, Hungary, Germany, Denmark, Dominican Republic, Iran, Iceland, Spain, Italy, Kazakhstan, Canada, China, Colombia, Malaysia, Mexico, Nepal , Netherlands, New Zealand, Norway, Poland, Portugal, Russia, Romania, USA, Thailand, Taiwan, Turkey, Ukraine, Philippines, France, Switzerland, Sweden, Sri Lanka, Estonia, South Africa, Japan. The United Arab Emirates even introduced the death penalty for the creation and development of financial pyramids. In China capital punishment is also possible for this.

Nor thieves, nor covetous, nor drunkards, nor revilers, nor extortioners, shall inherit the kingdom of God.

Working as an Internet project manager and launching start-up projects for clients, I often come across fraudulent financial pyramids. I come across customers of Internet projects and sites who use me «in the dark«, hiding their insidious plans from me. Only at the end of the project do I begin to understand that this customer cannot be dealt with and that he is a fraud. How to recognize fraudsters from a real investment project. It’s tricky, but there are major signs of fraud. There are basic signs of a real investment project. Even professionals sometimes fall for the tricks of scammers.

On the Internet, almost every day, there are more and more new opportunities to invest your hard-earned money in order to increase it. But to our great general regret, along with real offers from successful management and real investment companies, the sphere is overflowing with offers from scammers. Most likely, you don’t have to talk about the relevance of this issue once again, since we see cases of fraud almost every day. Even more or less experienced investors sometimes find it very difficult to distinguish a real investment instrument from a fraudulent offer, what can we say about beginners. It was with the aim of helping newcomers that I decided to describe the signs of fraud in the field of Internet investments …

But evil men and seducers shall wax worse and worse, deceiving, and being deceived.

So what are the signs that can help you discover the intentions of a fraudster in advance? Here is some of them:

1. Fixed income.

Most investments are quite risky and cannot be predicted with sufficient accuracy to determine a specific return in the future. Banks may be an exception, but most consider bank deposits not as an investment tool, but as a way to keep their funds from inflation. Even professionals with over a decade of experience cannot be sure how the market will behave in the future. Therefore, the promise of a specific percentage of profitability in the future is a sign of scammers.

2. The conviction of the uniqueness of the opportunity.

Very often scammers try to influence you through your subconscious, and thanks to the belief in a unique offer (a unique offer that is given to you only once in your life), they often manage to fool you. As a rule, all real investments do not have, by and large, any uniqueness, but they are based on well-known and publicly available opportunities. And in general, if you are obsessively convinced of something, this is already doubtful, at least this is a reason to think again.

3. There is no responsibility for losses or their distribution among the project participants.

Unprofitable periods are a reality for investing, and therefore the process of distributing losses must be agreed upon initially. If this initially does not exist - therefore, you are again convinced of a confident profitability, as I said, “this is not good” - again it may be a sign of a fraudulent scheme. In addition, I would like to draw your attention to the fact that this responsibility should be clearly stated (for example, in an agreement with a management company).

4. Urgency.

If you are offered to invest in something urgently, be 99.999 percent sure that at the moment you are communicating with a scammer. This is another method of influencing your subconscious mind. Urgency, as a rule, is not caused by any situation in the market, which can give excess profit, but simply artificially created so that you do not have time to analyze the offer and realize all the risks. The best decision at the time of such an offer is to refuse (refrain from investing). Most likely you will not regret this act.

5. Unclear formulation of conditions.

Avoid any vague wording. Sometimes, of course, this may not be a direct sign of fraudsters, but at the first opportunity, even real managers and not fraudsters will be able to "beat" you. The world of finance does not tolerate rough and vague definitions. Avoid words like "Approximate", "Tentative", "Planned" and so on. Money, like numbers, loves accuracy and counting. Remember this simple and working truth at the same time, it will help you and not only when investing. Approximately 7 percent it can be 0 percent or 20 percent, in this case the wording "from 5 to 10 percent" will be a little acceptable for you. This trick is often used by scammers, and by deceiving you, in fact, according to the agreed conditions, they remain "clean". Try to avoid such wording.

6. Using old fraudulent schemes, or schemas that are already overgrown with scandals and problems for investors.

Fraudsters don't have to invent something new. As the proverb says, “you shouldn't reinvent the wheel again…”. Fraudsters can use time-tested schemes to fool people. Therefore, try in every possible way to avoid those sentences where you see something similar to the old schemes. (Check the history of the company or the name of the owner of the investment company on the Internet. Perhaps you will find information that the owner has already created similar companies. Try to find at least one working investment company of this owner. You do not need to believe everything you are told, you need to see this live company and get acquainted with all the documents. Perhaps this company has a history with a "smell" and the owner has a dirty trail. Do not rush to invest in unverified companies and then lose them, it is better to check everything a hundred times.)

7. Offer to invest in know-how, or something that no one has seen before.

As a rule, real investment instruments are built on well-known schemes, which, as they say, is time-tested. And various legends about nano-technologies are more likely to be used by scammers, again together with the prospect of very high profitability. Even if this is really some kind of know-how, you must understand that potentially not only profitability is high, but also risks. If you are convinced that the probability of success is more than 60%, these are scammers. (People often say the following: Here I would disagree a little. But what about startups? Investing in startups of various nanotechnologies is popular now. This is promising and this is the future. I answer: Well, that's why 95% of such know-how of startups burn out. Better to invest in those business niches where there is a demand and a guarantee.)

8. The luxurious life of a manager or CEO.

If the managers have a consistently high income, they are unlikely to talk about this to their investors, since there is no need for this, this does not concern the essence of your transaction. “Throwing dust in the eyes” are mainly scammers, again to influence your subconscious. Like, look at how well I live, invest in me and you will live like that. Just think about the fact that a luxurious life implies very large expenses, and if a person has funds for these expenses, does he need your thousand and two? The question is rhetorical ... If you need it, it is just to cover these costs. (From experience, I can say the following, only 3% of the profit is invested by a fraudster in an investment business, the remaining 97% of the profit he spends on his own life and PR. He gives part of the money to his associates, so that they would confirm the profitability of his investment project. opened 1000 agency outlets, from each agent he took 100,000 rubles of investment. As a result, the project receives 100,000,000 rubles of profit, of which about plus or minus 3,000,000 rubles is spent on business. And he spends 97,000,000 rubles on his luxurious life as a manager. PR and not the development of an investment company. He creates for himself a positive image of a successful businessman. He takes pictures with the stars, buys houses and cars, buys himself expensive electronics. "Look how well I live, invest in me and you will live like this." another millionaire has appeared. The managing fraudster never shows full, certified by the state financial authority monthly financial statements. I always advise all clients to study a person's life before he became an investment project manager. Look at his life before ....)

9. Use of the so-called "Brokerage" scheme.

Under this scheme, the management company concludes an agreement with you for the provision of brokerage services. That is, in fact, you transfer funds into management, and according to the "securities", it is you who manage the account, therefore, all responsibility rests on you. And even if you go to court, your chances are rather small, besides, you will be responsible for the actions (even illegal) of the manager on your account.

10. My favorite point: Incredibly high interest rates and promises a fabulous guaranteed return - 300% profit.

Even Swiss banks do not promise that. Average interest rates on local currency deposits in Swiss francs was 2.74% per annum from 1974 to 2019. Whenever I see 300% in a recoam, I remember the words of the great man Thomas Joseph Dunning (1799-1873) - British trade unionist, publicist. “Capital,” says the Quarterly Reviewer, “avoids noise and abuse and has a fearful nature. It's true, but it's not the whole truth. Capital fears a lack of profit or too little profit, as nature fears a void. there is sufficient profit, capital becomes bold.Provide 10 percent and capital agrees to any use, at 20 percent it becomes lively, at 50 percent it is positively ready to break its head, at 100 percent it violates all human laws, at 300 percent there is no such thing a crime he would not risk, even on pain of the gallows. If noise and abuse are profitable, capital will contribute to both. Proof: smuggling and slave trade "(TJ Dunning, op. cit., pp. 35, 36 ). "

There are several more points indicating fraudulent actions of the investment company. When you see these actions, consider whether it is worth investing your money in the company.

Now in Russia there are financial lawyers who help to fight investment fraudsters. The fight against financial pyramids is constantly being toughened in Russia. Now in Russia it was proposed to introduce administrative and criminal liability not only for the creation of financial pyramids, but also for its advertising.

Every year a huge number of people suffer from financial pyramids. Every person says that this does not concern me. But more and more victims constantly fall into the trap of scammers. If you see these 10 points, think about it, count all the options and only then make a decision.

What makes a real investment company different:

1. Transparency (openness) of the investment company.

This company publishes financial statements every month. How much investment funds were received, how much money was spent on the development of the company. Remember — this is very important: the company never pays salaries to employees and interest on investment money. The company pays these costs out of the profits earned. The company carries out full financial activities, you can check it with the tax authority, how much taxes the company has paid and compare it with the financial statements. You can check the company in the register of registered companies and get a complete financial statement for it. The company draws up a business plan, discusses it with the board of directors, the company adheres to this plan and reports on it to shareholders.

2. A real investment company never hides its history, reporting, contacts with the manager, board of directors and CEO.

Always, always check the history of the company or the manager on the internet. A real investment company has a lot of open information for review. The real company always exposes contacts with management to resolve urgent issues. A true leader is always responsible for the actions of his investment company. See reviews about the company and the manager. The manager may have been involved in similar cases of fraud in the past. Scammers usually wait some time after the closure of previous pyramid schemes. So that the noise will subside and the past scandals become a thing of the past. View information about the manager for 10 years. Usually scammers open companies in the name of non-existent people or there is no information about the owner of the company at all, this makes you immediately alert. Fraudsters often change their accounts. A real investment company never hides its history, even if there were negative moments in it. Many managers are famous and public people. They do not hide their income and plans. And if there are problems in the company, then the manager takes all responsibility upon himself, and does not impose it on force majeure and the incompetence of investors. Investors do not have to deal with the company’s affairs at all, they have already provided their money.

3. Money is loved when it is counted.

Never, never invest money at the behest of your heart. Remember that any pyramid scheme lasts from 1 to 3 years. It is very rare for pyramid schemes to live longer, although there are well-known examples in Russia. This company is the Joint Stock Company «MMM«, it existed for 5 years (1992-1997) (https://en.wikipedia.org/wiki/MMM_(Ponzi_scheme_company)), and the Closed Joint Stock Company «Russian House Selenga» it also existed for 5 years (1992-1997) ( https://ru.wikipedia.org/wiki/Русский_Дом_Селенга). It is necessary to weigh everything well, calculate, learn the history of the company and head and only then make a decision. Remember that professionals can not always immediately understand who they are working with a fraudster or a real investment company.

If you nevertheless fall for fraudsters, write a statement to the prosecutor’s office, to the police, to the checking state bodies, to the tax office. The State Financial Authorities will give one hundred percent assessment of this company and if they recognize the company as a pyramid scheme, then its founder will go to jail for a long time. It is possible to return your money only at the moment when the company has an influx of new investors. When there is no money left to pay the next participants, SCAM occurs.

What does a project scam mean?

Let’s deal with such a classic concept in the world of pseudo-investment and investment too. What is SCAM and what can be considered a scam?

Scam — translated from English is a scam, a fraud.

Therefore, if you are engaged in the real sphere of the economy, investment, then in fact, any pyramid and high-yield investment program (HYIP) can be initially called SCAM. ( https://en.wikipedia.org/wiki/High-yield_investment_program )

Because in any case, at a certain stage, all depositors will be cheated with payments and only the very first depositors and refodes will earn. Therefore, if you are a serious person, far-sighted, economically savvy, and also do not try to solve your problems at the expense of others, then you can safely call any hype or pyramid — SCAM, even if it pays to all partners in a given time period.

In the language of people who work in the field of pseudo-investment (pyramids, HYIPs, mlm games, projects with binars, dinars, etc.), scam is another concept.

For them, a scam is when there is already a pyramid, the HYIP does not pay at all. Then they shout: «guard, SCAM«. But it’s’ too late. For us, SCAM in the world of pseudo-investments is when a project pays, but not to everyone. For example, John the referrer withdrew money, but Michael the investor could not withdraw. This is already SCAM. Then everything will be on the rise, no matter what legends the project management would come up with. After some time, payments will stop and the bubble will burst.

Even if a small number of participants cannot withdraw money (we do not take into account the delays of payment systems and errors), this is already a scam. And a competent HYIP player, having found out that problems have begun, will not reinvest and will try to withdraw everything. And by inertia, the pyramid will work for some time. One of the pyramid schemes has been collecting money for the second year already, although there have been problems with payments for a long time. And just at this time, those who lose their funds by 100% come in and at the expense of these people they earn or at least pay off those who came earlier.

I hope this information will help you reveal the intentions of the scammers. Remember that by and large it is impossible to trust anyone, especially in those matters that relate to financial issues. You can listen to what you are told, but by no means take the information as a call to action.

With respect to you and your business.

P.S. There are international databases of fraudsters. I was offered with the help of a group of programmers using the tools of an ethical hacker to add new names of scammers and materials proving fraud to these databases. If you have encountered such a fraudulent scheme, write me a private message. We will check your information.

In Russia, there is a saying: «No matter how much you twist the rope, this rope will end up all the same.» This means: It is said with confidence that bad deeds, actions will come to an end. I have always wondered why scammers do not think that their affairs concern their family. That they will still have to answer for their deeds. Remember that the person who justifies the fraudster’s actions is his accomplice. A fraudster will never admit to cheating. The ability to gain people’s trust is the main weapon of a swindler. After he received what he wanted from you, he stops communicating with you. Take care of yourself and your loved ones. Take care of your savings and trust them to trusted companies.

Contact me in a way convenient for you

CONTACTS

- +7 (964) 080 9662

- arkady.kondratenko@gmail.com